IRS Direct Pay Portal Walkthrough

In late December, the Treasury and IRS opened up a registration portal for firms and other entities to access the elective payment provisions in the Inflation Reduction Act (IRA). This portal allows elective pay-eligible entities to pre-register before they file the tax returns which will allow them to claim credits. It does not guarantee that any entities submitting pre-registrations will earn their credits—rather, it allows the IRS and Treasury to gain advance visibility into who is claiming credits and for what projects they’re doing so.

The Treasury and IRS published a comprehensive user guide that serves as an adequate walkthrough of the portal and all it offers. The guide references the rules and regulations surrounding various credits and credit transfer rules in the IRA (and CHIPS, the landmark semiconductor investment bill), and provides various credit resources in the appendix. The IRS also acknowledges that final rulemaking for various aspects of the law have not been published yet.

This blogpost will walk through noteworthy aspects of the user guide, drawing from and following up on a tweet thread I wrote in early January.

Most importantly for general awareness, the guide includes a table (Table 1) mapping out which entities can access elective payments or make use of credit transferability provisions across the range of applicable tax credits. This table is maybe the first of its kind, and will likely change when final elective pay rules are (hopefully) published in the coming weeks.

All entities need to choose whether they’re seeking elective payments (P) or a transfer (T).

The guide stresses multiple times, however, that the portal allowing the above entities to take advantage of the above range of credits is not a substitute for regular and timely tax return filing. Pre-registration of credit-eligible facilities and projects through this portal does not obviate any project developer’s need to submit a tax filing to actually receive and/or transfer a tax credit or elective payment. Every entity using this portal will need an employer identification number (EIN), even if they are a tax-exempt elective pay-eligible entity. Pre-registrants will need to secure the EINs of their subsidiaries as well. The IRS provides instructions for acquiring an EIN here. The images below clarify these points.

In preparation for actually disbursing credits and elective payments, the IRS and Treasury will give unique registration numbers to all properly submitted projects (these are different from the EINs, since they are for each project and not for each applying entity or its subsidiaries). Entities looking to pre-register their projects can submit only one registration package in a given year, regardless of how many project registration numbers they need to secure in each package. This requirement forces registrants to determine which projects will apply for and be eligible to receive elective pay before pre-registration, a process which the applicant will have to undertake well before filing their tax returns—currently recommended to be 120 days before filing the return but not earlier than the beginning of the taxable period in which applicants expect to receive payments. Since the annual filing deadline is April 15, projects should expect to submit pre-registration in early-January of the year in which they want to get paid. . And once an entity submits its pre-registration package, there is no taking it back! The portal is designed to prevent pre-registrants from editing anything in their application after they submit it—until at least 120 days afterwards, after which the IRS and Treasury have promised to respond to notify applicants of errors and comments.

If a registration application, or “registration package,” is not fully approved and some projects do not receive registration numbers, the IRS will notify entities through the portal and allow them to amend their submissions. (The IRS suggests that it’s not a bad idea for any entity to submit amendments after their initial pre-registration submission depending on which projects need credits at which times.)

Importantly, the guide highlights that registrants will have to know what types of returns they have previously submitted to the IRS. For tax-exempt entities, “None” is an option.

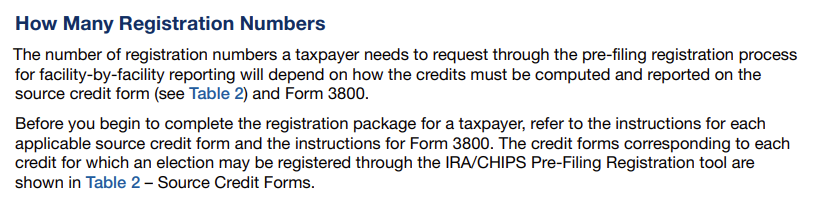

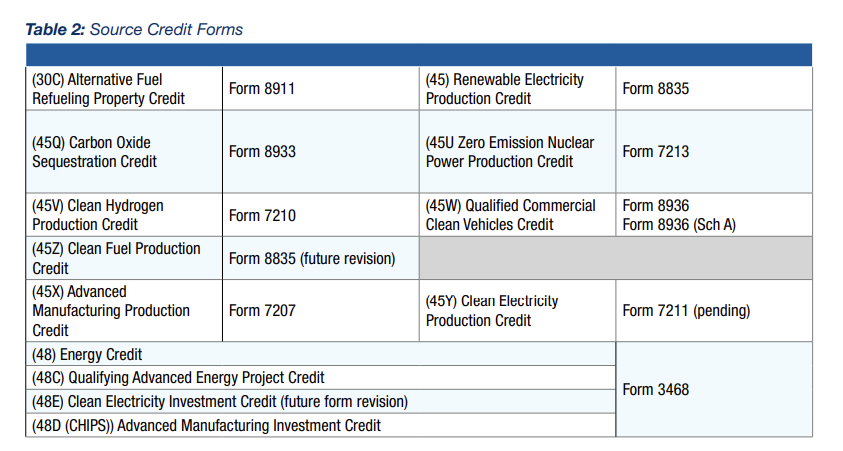

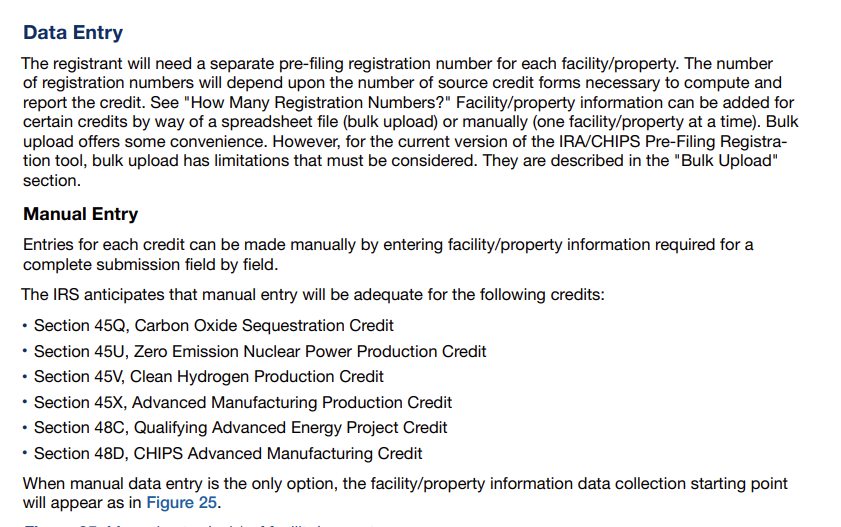

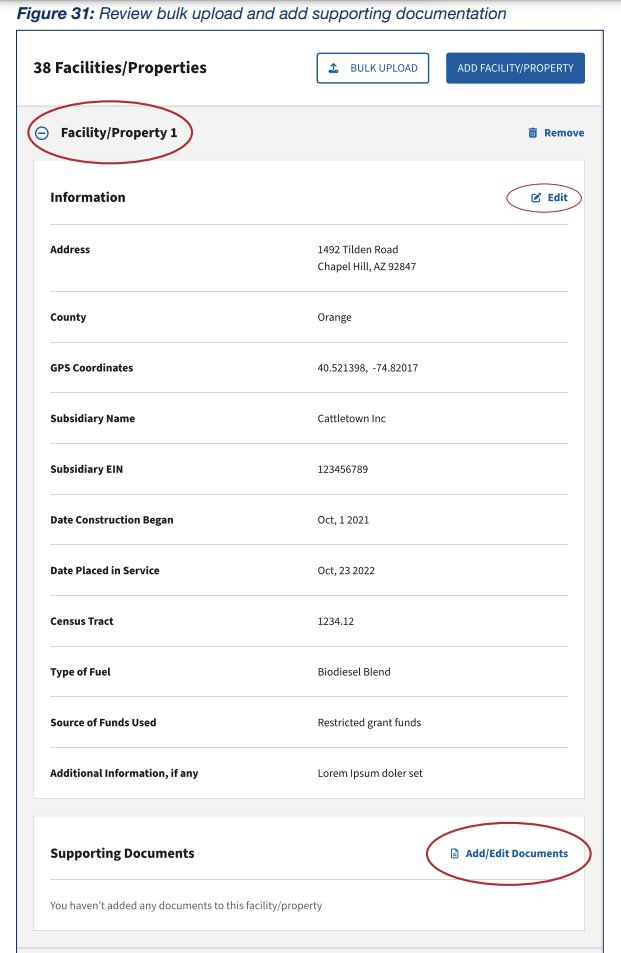

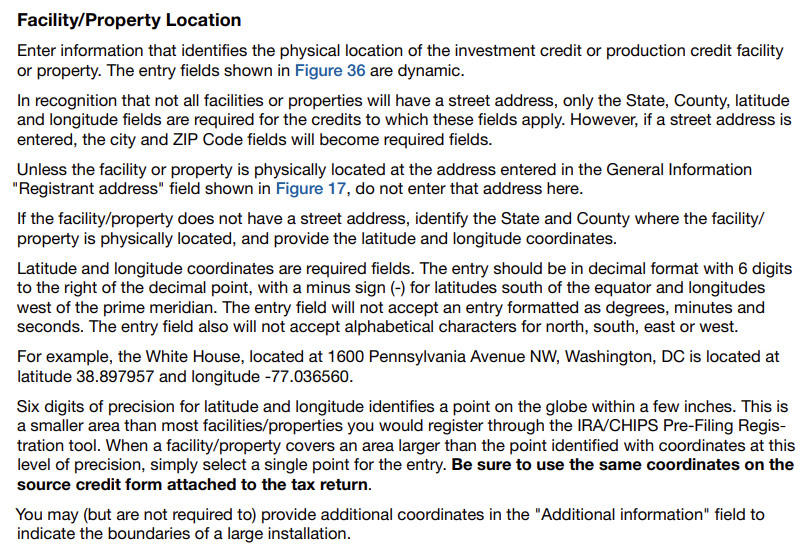

Every pre-registrant submitting a package seeking credits/elective payments for multiple projects is looking to receive a unique registration number for each project they have submitted. The guide helps registrants identify what forms they need to file for each project to justify that each project is actually eligible for the credit being asked for (Table 2). Registrants manually can list all the projects they’re submitting for, or they can use a spreadsheet template provided in the portal to submit a list in bulk. The information required for each project—including incredibly specific location data—is the same either way.

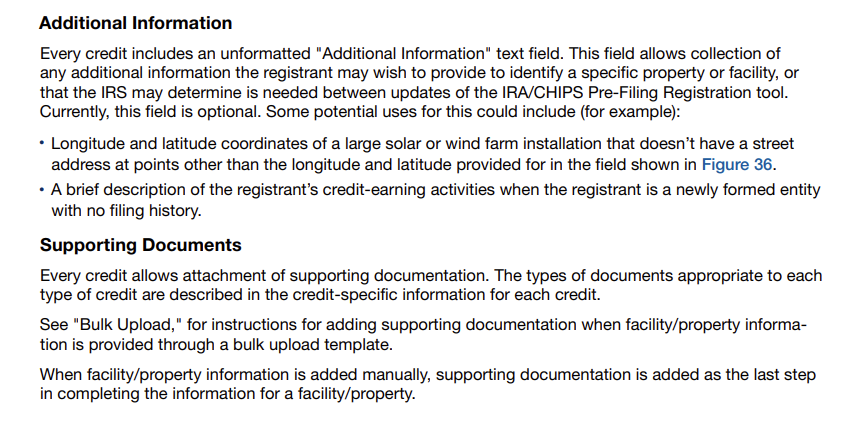

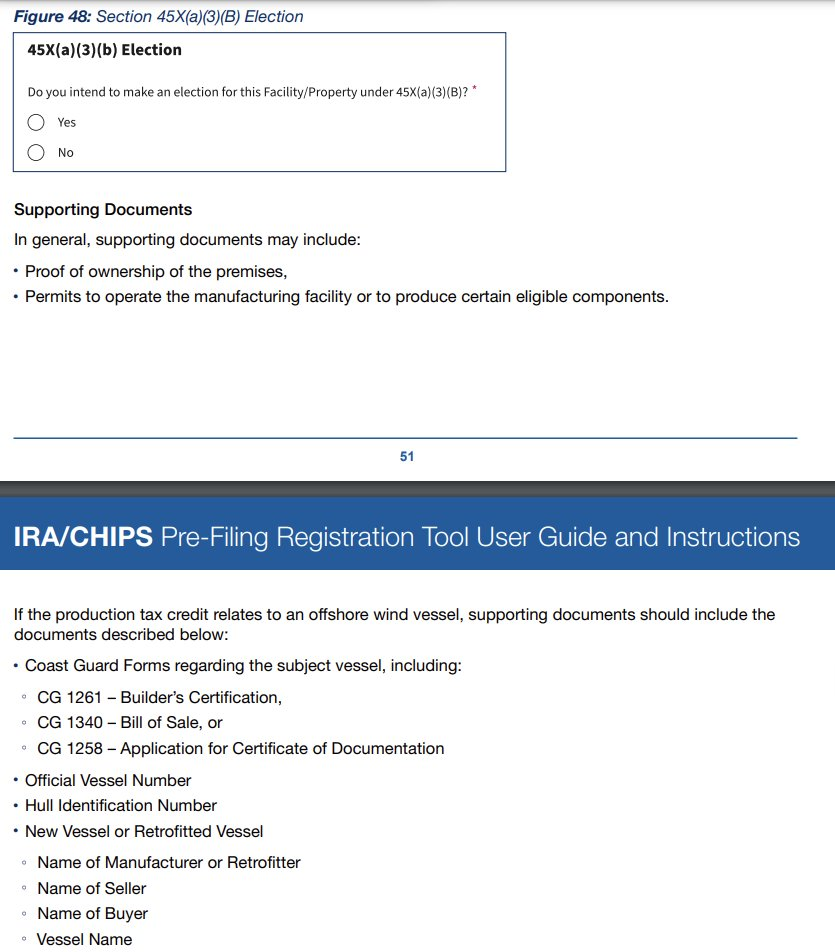

Registrants need to have additional information and supporting documents ready for each project they’re seeking credits/elective payments for. The guide provides comprehensive information on what registrants need to submit to claim eligibility for any given credit; below are examples of what additional information the IRS and Treasury need to see to grant a 45X or 48 credit:

Crucially, all projects submitted in a registration package need to be placed in service before or on the date of being registered through this portal. This requirement is more important than it may seem—not only do entities need to submit their pre-registration packages 120 days or more before the tax return deadline (in January), but their projects need to actually be operating by then.

As mentioned earlier, the IRS will assign each project/facility a unique registration number. But if the IRS finds errors or if project development circumstances change, registrants can always amend their submissions in a new submission package, under certain conditions. If the IRS identifies errors or has comments that require registrants’ review, registrants have 35 days to address them and resubmit, or else those registrants lose their place in the IRS’s review queue.

Finally, as specified by a Treasury official in a webinar with the Beneficial Electrification League, all entities claiming elective pay or transferability need to use their registration numbers on their tax filings to earn their payment or transfer their credit. Entities with no tax liability have a six month extension on filing their return.

That’s the relevant information we identified in the guide. The Treasury held a webinar on January 17 describing this portal and the current state of elective pay rulemaking but did not provide substantial further detail. The IRS published a video walkthrough of the pre-registration portal. The IRS is holding office hours over the coming weeks; more information can be found on the IRS’s guidance page here. Already, entities have pre-registered over 1,000 projects!

To summarize:

Pre-registration is no substitute for tax filing.

Everyone needs an EIN. Get yours here.

Only one registration package per entity per tax filing year, with room for amendments. Submit at least 120 days before the tax filing deadline—submit in January so long as the tax filing deadline is in April.

Every eligible project/facility in the package requires detailed filing and documentation.

Every eligible project/facility must be placed in service at the time of being included in the pre-registration application.

Every eligible project/facility gets a unique registration number.

Errors need to be corrected within 35 days through an amended registration package submission.

Use registration numbers on tax returns.

Missing anything? Let us know!